Senators Bob Casey and Vincent Hughes tour 52nd Street small businesses

Media Outlet

Kiara Santos

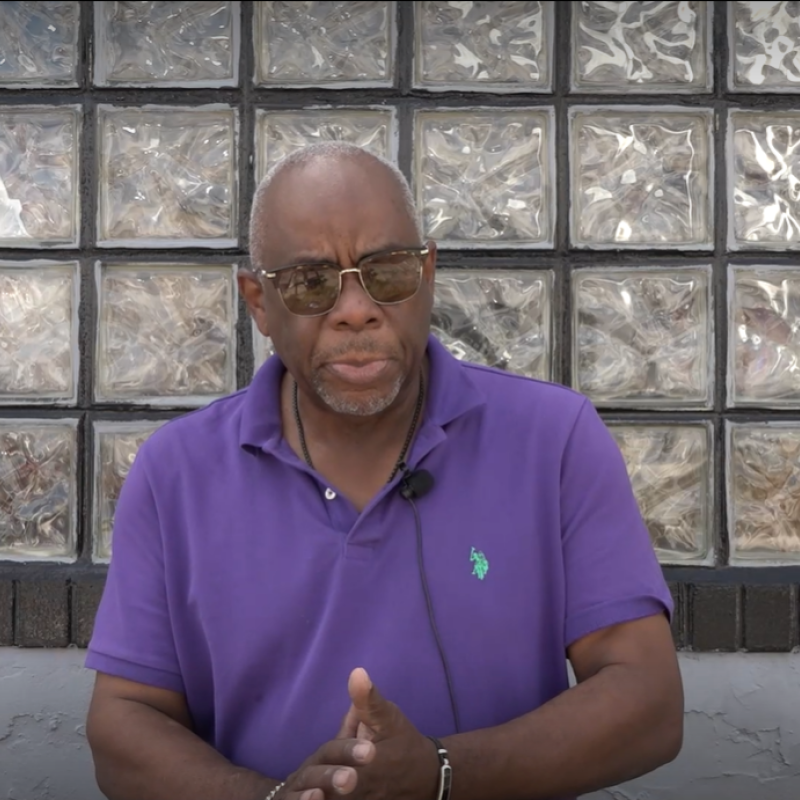

Some business owners in West Philadelphia had the opportunity to showcase their services to U.S. Sen. Bob Casey and State Sen. Vincent Hughes during a walking tour of 52nd Street on Friday.

During their walk, the two talked up the expansion of capital funding along the corridor, which is considered West Philadelphia’s main street. And learn more about the work the Enterprise Center is doing to help small Black business owners.

“We have reached the point that in order to have a strong economy you got to fix your infrastructure and the federal government checked out of that for so many generations,” Casey said. “We’re finally starting to make those investments.”

The residential area that surrounds 52nd Street suffers from entrenched inequities: compared to the city, the corridor’s residents are predominantly Black, poorer and less educated, according to a study by the Enterprise Center.

Hughes was also on hand last month during Gov. Josh Shapiro’s “Main Streets Matter” tour, which took him to other Black-owned businesses in West Philadelphia such as Hakim’s Bookstore and Two Locals Brewing Company.

Owners of Brown Sugar Bakery & Cafe and 2nd Threadz T Shirts talked to Casey about their experience of being small business owners.

Kelly Pownsend, owner of 2nd Threadz, said this winter was his slowest ever for foot traffic.

“The summer wasn’t as busy,” she said. “I don’t know why people aren’t spending foot traffic. It’s not necessarily foot traffic because I’m in a good area. I do promotions on Google and stuff like that, but it’s just like people aren’t spending as much as they have in the past, like even before COVID, it was this year. So, I’m not sure what’s going on.”

Pownsend also raised her concerns as a woman-led minority business owner and the little protections she has as an owner and operator. She cited consistent fraudulent returns and people who scam for refunds.

However, she considers her business to be a “blessing.”

She spoke to Casey and Hughes, who noted the need for legislation to protect some owners who are struggling financially.

The senators then stopped by the Trindadian bakery and cafe, where Casey told The Tribune how places like Brown Sugar need care through the 401Kids Saving Act. The bill provides children with lifetime savings accounts that they can use toward college, homeownership or entrepreneurship.

Data shows that millions of younger Americans are on track to have less wealth than their parents at a similar age.

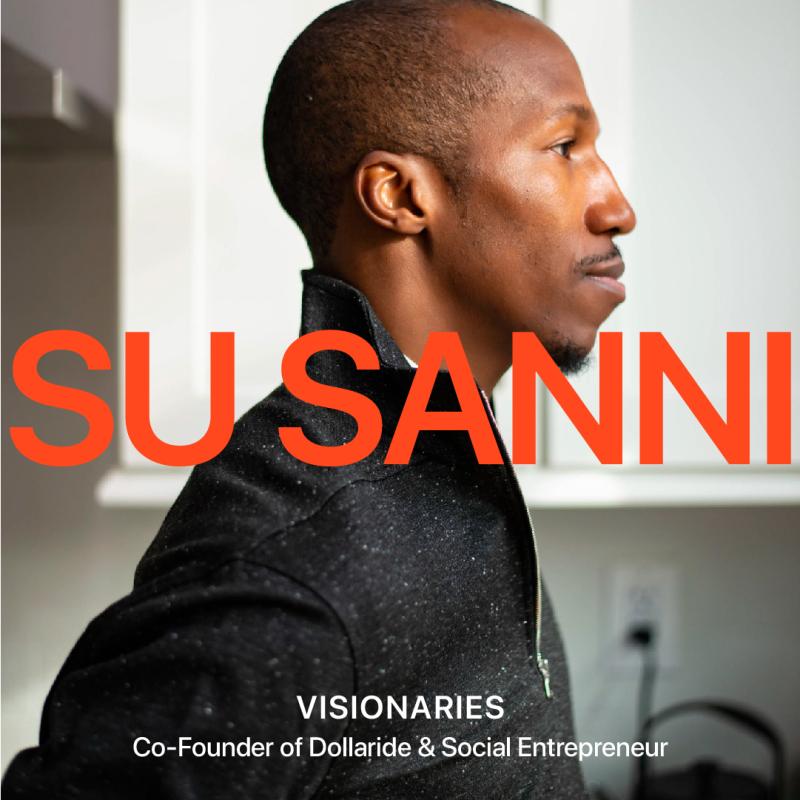

The Enterprise Center is a 30-year-old operation with a mission to promote equity and diversity of small businesses in West Philadelphia.

Once a project branched out from the University of Pennsylvania’s Wharton School of Business, the organization acquired its own 501©3 non-profit status and has grown under the leadership of Della Clark, its president.

The center has helped local businesses revitalize their street fronts, and provided an entity called Biz on Wheels.

The program is stationed in a renovated bus equipped with free Wi-Fi, a printer and scanner for important documents.

“I’m a capital revolutionary,” Clark said. “I’m a mitigator. A connector. These are my talents. I’ve been doing this work for a long time.”

Clark spoke with the senators about the nuances surrounding funding received under the State Small Business Credit Initiative, also called SSBCI.

Clark spoke about how she gave back money from the initiative, not because of its success, but because many applicants lied about their income to be considered for the program. The SSBCI is designed for “cash flow,” according to Clark.

The loans help with the conditions of small businesses but do not encompass strategic development to help straddle the businesses into their next step.

In total, she said, she turned back $2.5 million in SBCI funds.

“The program is there, but it needs to be stratified better,” Clark said.