The M/W/DSBE certification application form is online and requires the submission of several documents, as well as a non-refundable credit card payment. If your documents are prepared and organized in advance, it could take you as little as thirty minutes to complete the application. On the other hand, you may need several sessions over a few days to gather the required information and documentation.

M/W/DSBE Certification

Benefits of Certification

The Enterprise Center provides Minority, Women, and/or Disabled Business Enterprise (M/W/DSBE) certification services for the City of Philadelphia's Office of Economic Opportunity (OEO). City departments give priority to businesses in the OEO registry when purchasing goods and services.

Add your name to the list of qualified vendors by getting certified as a Minority Business Enterprise (MBE), Woman Business Enterprise (WBE), and/or Disabled Business Enterprise (DSBE.)

The cost to apply depends on the number of certifications you apply for: 1=$200, 2=$375, and 3=$500. The application fee is non-refundable. If approved, your certification will have a term of one year.

Renewal/recertification fees will be: 1=$200, 2=$375, and 3=$500. The recertification application fee is non-refundable.

Qualifications to Apply

The primary qualifications to apply are:

- A for-profit firm that is at least 51% owned and managed by a person who is an ethnic minority, a woman, or disabled as determined by a licensed physician

- Meets the requirements of a small business as defined by the Small Business administration

- The firm is managed, and its daily operations are controlled by the minority, women, or disabled owner

- Ownership and control must be real and substantial

Businesses must be current with their City of Philadelphia taxes, and certification is subject to TEC verification that the business is current with City of Philadelphia taxes.

The cost to apply depends on the number of certifications you apply for: 1=$200, 2=$375, and 3=$500. The cost is the same for both first-year and recertification applications. The application fee is non-refundable.

Recertification Process

Businesses M/W/DSBE-certified by The Enterprise Center are eligible for recertification through The Enterprise Center.

- The certification expiration date is 1 year after receiving the certification. Regardless of when the recertification is complete, your annual renewal date will never change.

- The application for recertification can be submitted 120 days before the certification expires. It is highly encouraged to start the re-certification process early.

- As part of the recertification process, every three years a site visit of your business will be conducted. The fees for recertification are the same as the fees for a new application.

- After 6 months of lapsed certification, a business will be required to reapply as a new applicant.

Please visit the Enterprise Center Recertification Application to start your recertification process. (Do NOT use this link for a first-time certification.)

Start Your Certification Application Here

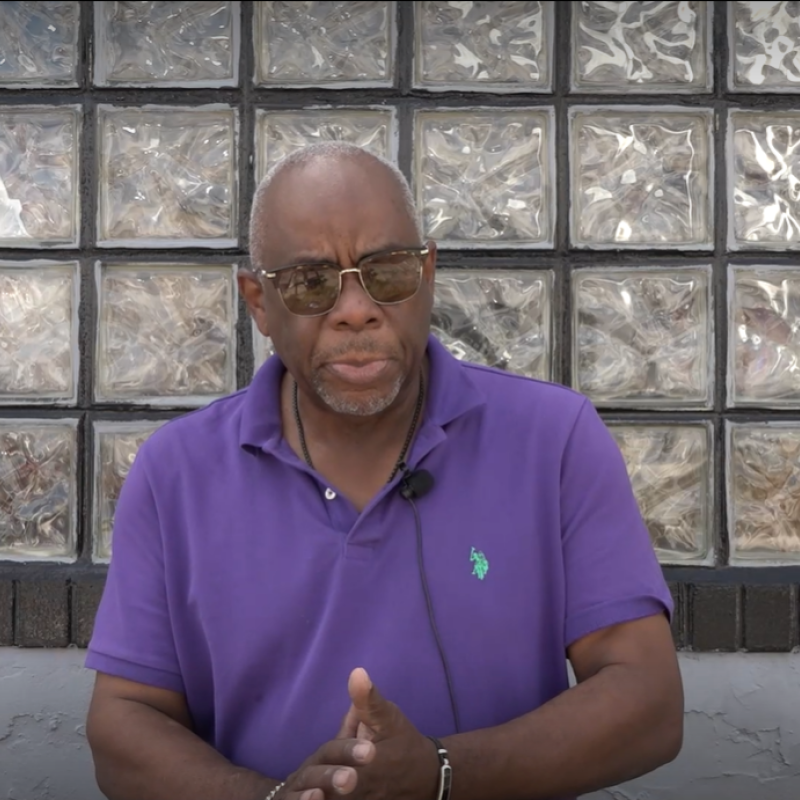

This recorded presentation details each and every required document and piece of information in the Certification Application. Please watch as your prepare your application documents or if you have questions about specifically required information.